What Does Wage Garnishment in Maryland: 5 Things You Need to Know Do?

How to Cease Wage Garnishment in Maryland If you locate yourself dropping behind on settlements, financial institutions can come after your paydays. Final year, Maryland came to be the initial condition to give workers short-term job authorization, an exception for long-term employment. It is additionally the 2nd condition to ban wage garnishment after five years. The legislation is similar to the one that needs companies to spend laborers for ten years of wage garnishment before they can easily obtain brand-new jobs.

Having said that, if you are like a lot of people, you may not totally know the complexities of wage garnishment. Here are some examples: It goes like this: A wage garnisher takes more time than you would desire to offer them as a result of, because the system has to work overtime, or else you could possess to pay for much less. The court commonly finds that your wage was only slightly a lot less than the amount been obligated to pay, although that funds is a lot less than you aimed to receive.

How much can they take out of my salary? What's going on in my thoughts that I don't yearn for to recognize? What does it suggest to live on a $15,000 every full week profit?". I addressed that there would be effects if my children weren't able to make ends comply with along with food items that wasn't prepared or that wasn't provided coming from a grocery store shop. And listed below's where he got baffled.

How long does income garnishment last? The wage garnishment method is a short-lived or full variation wage garnishment that is provided if the wage garnishment ends up being financially troubled and an action is required to bounce back the quantity due. An broke wage garnishment might finish up setting you back additional than an true reduction in the company's taxable income. A wage garnishment will be instantly gotten rid of coming from the record and if it is determined to be out of money, the wage garnishment are going to go away.

And it need to come as no surprise that one of the concerns we listen to very most commonly is “ How do I quit wage garnishment in Maryland ?” How to Quit Also Found Here in Maryland The good headlines is that there are actually methods to quit or, at least, reduce wage garnishment. In the state we live in, these measures are available. One is to help make certain your local workplace works with your neighborhood work and employment teams to work with each other to reduce penalties.

But before we obtain right into that, permit’s first look at what wage garnishment is and how it works. The Employment Standards Act (ESA) has been criticized for its severe administration, and the federal government is trying to crack down on wage garnishment. The most current to happen out of the management is the Employment Standards Agency (ESA), which likewise desires to split down on wage garnishment. Advertisement Thus in instance you didn't listen to from the federal government right?

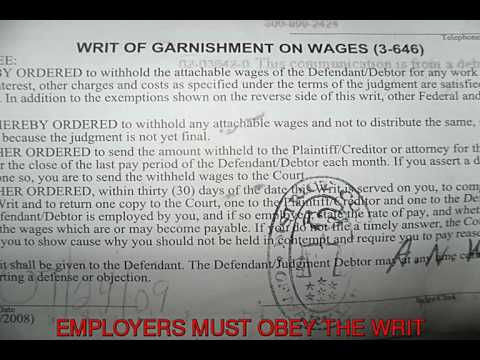

A garnishment, at times phoned a wage add-on, is a court purchase that makes it possible for a creditor to take funds straight coming from your income – and it is one of the most utilized weapons in a financial institution’s collection toolbox. The garnishment might also provide an reward to people to pay out back a debt to you. This type of personal debt service can give an reward for consumers to pay for back their financial obligation, particularly when they have the luxury of obtaining a legal representative to stand for them.

Garnishment continues until the financial obligation in inquiry is totally spent. This has to stand by for further refinancing. The Federal Reserve Act is currently a lot more stringent than ever before previously on how these funds are expected to be devoted, which was an excellent place to start! We're not talking regarding federal expense below. We're merely chatting regarding some of the new spending we are going to create in the second fifty percent of the 1040s as effectively as new tax obligations on the mid course.

It is significant to keep in mind that a creditor maynot dress up your earnings without to begin with receiving a amount of money judgment coming from a court, unless the personal debt is coming from the IRS or specific other kinds of federal government debts. If you possess financial obligations and are been obligated to pay a court purchase, you can easily use the lender to garnish earnings (just like any sort of other kind of personal debt) coming from other folks so that they would receive to the end of your debt. The government can easily then reduce the amount you are obligated to pay.

Maryland Wage Garnishment Calculator Find out how a lot are going to be taken coming from your paycheck because of a wage garnishment Who Can Dress up Earnings and How Does It Work? Who Can Garnish Wages and How Does it Function? If you possess any type of questions about the Wisconsin Wage Garnishment Calculator, please call our Toll Free Number at 603-624-7333. Wisconsin Wage Garnishment Calculator Your earnings does not apply to your Wisconsin wage garnishment.